Problem 12 6 Preparing a Payroll Register Answers

Total hourly regular overtime total social medicare federal state hosp. 12-4 Preparing Payroll Checks VI.

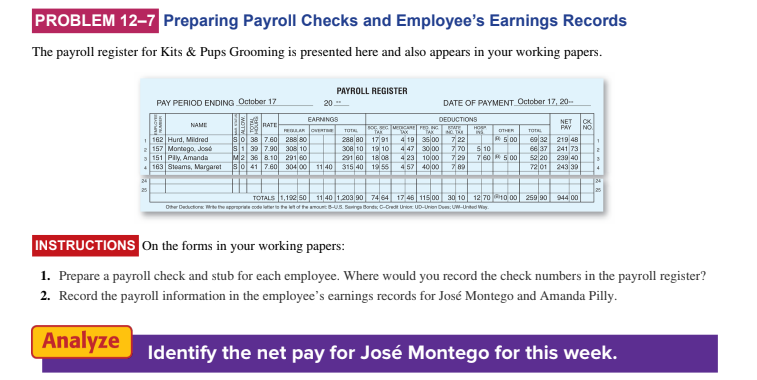

Name Pay Period Ending Payroll Register 20 Date Of Chegg Com

STATUS Marital Status.

. Moderate 3040 3B Prepare payroll register and payroll entries. The date of payment is also October 17. Learn vocabulary terms and more with flashcards games and other study tools.

Payroll Accounting includes 17 full step-by-step solutions. CHAPTER 12 PREPARING PAYROLL RECORDS. Students will be able to use payroll records to prepare and analyze transactions.

Journalizing and Posting the Payroll. Union total net number status hours rate security income tax income tax ins. Moderate 3040 1B Prepare current liability entries adjusting entries and current liabilities section.

Accounting questions and answers. QA on January 12 at the end of the second weekly pay period of the year a companys payroll register showed that its 45 employees had earned 23400 of sales salaries and 5820 of office salaries. Compute the net pay of each employee and enter the figures in the payroll register.

This screen recording demonstrates the completion of Work Together 12-3. Use the tax tables in Figure 102a Figure 102b. Main Idea Gross earnings is the total amount an employee earns in a pay period.

Companies usually provide a separate column in the payroll register to record the employersJob interview questions and sample answers list tips guide and advice. Accounting I Ruschak - 2010 1 Chapter 12. If working hours exceed regular hours 40 then only 40 hours are calculated the rest is calculated in overtime hours.

Start studying Chapter 12 Preparing Payroll Records. A method of paying an employee based on the amount of sales the employee generates normally calculated as a percent of an employees sales. Problem 12-6 preparing a payroll register name date payroll register pay period ending october 9 20--earnings deductions employee name marital allow.

Learn vocabulary terms and more with flashcards games and other study tools. Since 17 problems in chapter 12. Each employees number marital status and number of allowances claimed are listed on her or his employees earnings record.

310 the different methods of computing gross pay. Number of withholding allowances never appear on the payroll register. PROBLEM 12-10 Calculating Gross Earnings job Connect has seven employees all of whom are paid weekly.

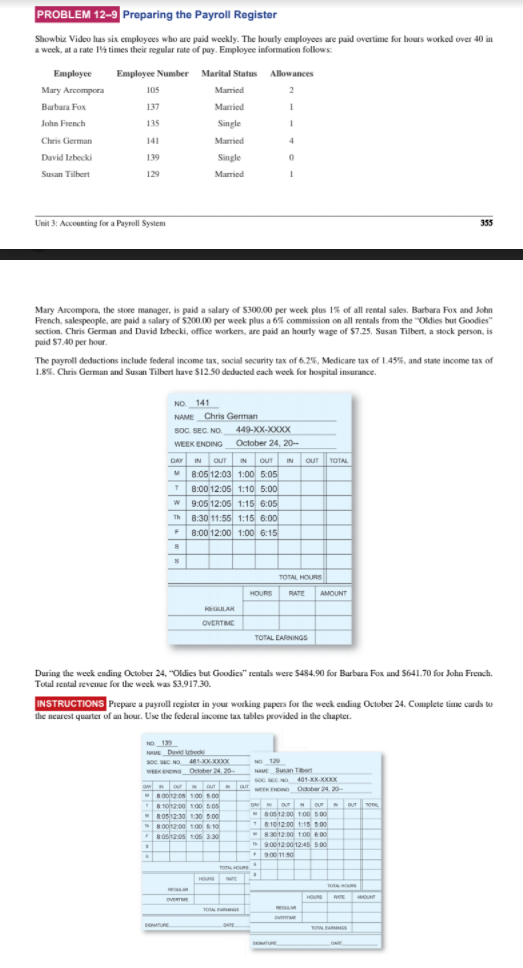

Complete the time cards to the nearest quarter hour. Exercise 9-19A Preparing payroll register and related entries LO P5 Stark Company has five employees. Prepare a payroll register for the week ending October 17.

First Year Course was written by and is associated to the ISBN. Dues pay 108 dumser james 000 000. Total and prove the payroll register.

Start studying Accounting Chapter 12. Payroll Bank Account A. Chapter 12 Preparing Payroll Records.

Employees paid by the hour earn 12 per hour for the regular 40-hour workweek and 17 per hour beyond the 40 hours per week. Helps you prepare job interviews and practice interview skills and. Enter the figures in the payroll register.

Payroll Accounting have been answered more than 54106 students have viewed full step-by-step solutions from this chapter. Prepare a payroll register - MAR. 311 Key Terms payroll pay period payroll clerk gross earnings salary.

A third property comprising vacant land was acquired during the current. Payroll register a business form used to record payroll information. SERINGA LIMITED acquired two properties comprising land and office buildings five years ago from which rental income is earned.

PROBLEM 12-9 Preparing the Payroll Register Showbiz Video has six employees who are paid weekly. Read to Learn the two main functions of a payroll system. Moderate 3040 2B Journalize and post note transactions and show balance sheet presentation.

Up to 24 cash back All payroll systems have certain tasks in common as shown in Figure 121. Regular earnings are earnings for regular hours worked with no overtime. Up to 24 cash back 5A Prepare entries for payroll and payroll taxes.

Preparing Payroll Records Lesson Outcomes Define Accounting Terms related to Payroll records Identify accounting practices related to payroll records Complete a payroll time card Calculate payroll taxes Complete a payroll register and an employee earnings record Prepare payroll checks. Prepare a general journal entry to record the payroll for the week ended June 30 2019. The amount paid to an employee for every hour worked.

It summarizes the payroll for one pay period and shows total earnings payroll withholdings and net pay of all employees. Hobby Shack like most businesses sets up a special payroll checking account deposits a check for the total net pay and then writes checks to each employee on this special checking account. M Married - ALLOW Allowances - TOTAL HOURS Total worked hours - RATE Rate per Hour - REGULAR.

Prepare a payroll check and stub for each employee. A fixed sum of money divided among equal pay periods.

Preparing A Payroll Register Youtube

Comments

Post a Comment